Is your paycheck barely lasting you till the next one?

Free Financial Health Checkup

Feeling trapped in a cycle of work, bills, repeat? You're not alone. Millions of salaried Indians face the same struggle. But what if there was a way to break free and build a future where your money works for YOU?

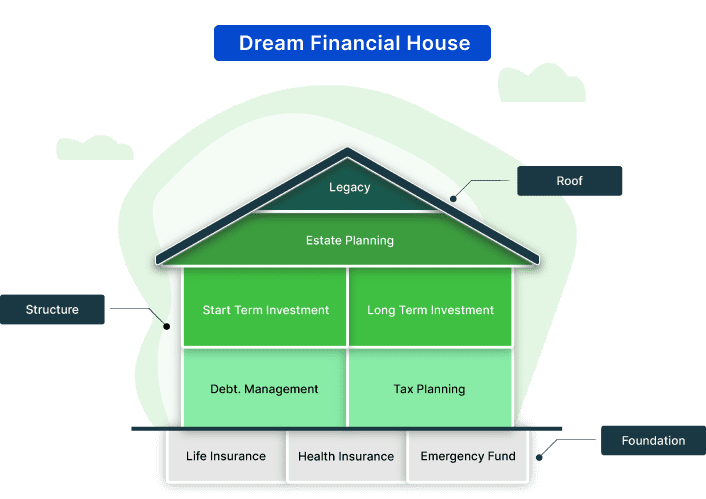

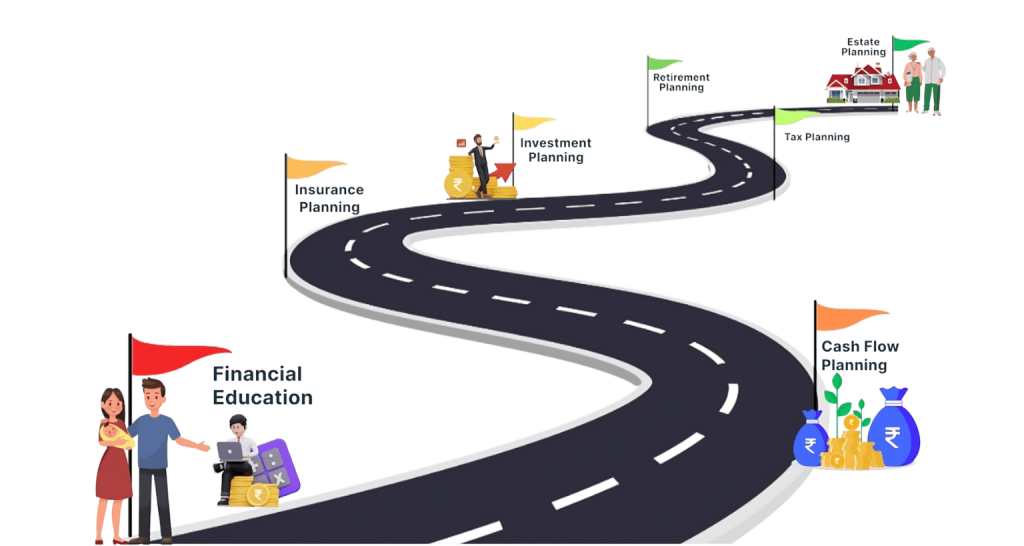

Finvestera helps you plan your life, from education to retirement.

Our end-to-end planning covers it all - education savings, salary management, retirement planning, and even that dream vacation fund. We help you navigate life's milestones with financial confidence.

What is FINVESTERA?

Finvestera is New era of Finance, Insurance and Investment

Our Offering

Insurance: Secure Your Tomorrow

Comprehensive insurance solutions tailored to protect what matters most, so you can live with confidence.

Investment:Grow Your Wealth

Intelligent investment strategies designed to help you build and safeguard your financial future.

Learn: Empowering Financial Literacy

Unlock the secrets of finance with expert guidance and educational resources.

Why you need to #KnowYourFinances

Understanding your finances is important. Imagine finding yourself in a debt cycle, unable to save for emergencies or dreams. Financial literacy allows you to break free, create a secure future, and enjoy life on your own terms.

- Only 27% of people are financially literate

- Over 66% of peopleare stuck in this cycle

- Bank sitting on ₹30,000 Crores Unclaimed deposits

- LIC is sitting on ₹21,500 Crores Unclaimed funds

- 5. 60% of weddings financed by loans

- 9. 70% demat accounts lack nominees

- 12. 75% of Indians do not have an emergency fund

How Can We Help You?

Are You Ready to Take Control of Your Financial Journey?

Finvestera isn't just a brand; it's a movement. With a growing community of 350k+ followers across all social media platforms

At Finvestera, we believe that financial education is the key to a secure and prosperous future. Our social media platforms are a treasure trove of valuable information, offering everything from practical budgeting tips to advanced investment strategies.

Our Impact:

- Spreading Financial Literacy: Through engaging content, webinars, and expert advice, we’ve reached [Number] people, empowering them to make informed financial decisions.

- Breaking Financial Barriers: By simplifying complex financial concepts, we’ve helped [Number] individuals overcome financial challenges and achieve their goals.

- Building a Trustworthy Brand: Our commitment to transparency and ethical practices has earned us the trust of [Number] followers, making us their go-to financial advisor.

- Driving Positive Change: Our initiatives, such as [Mention specific campaigns or projects], have contributed to [Positive impact, e.g., increased financial inclusion, improved financial well-being].

2 Cr+

Views

1.2 Lakhs+ hrs

Watch time

4 lakhs+

People’s likes

3.5 Lakhs+

Followers

Tired of paycheck-to-paycheck living?

Ready to transform your financial future? Watch our video to discover how Finvestera can help you achieve your dreams.

Discover the Finvestera difference. Learn how to break free from the financial rat race, build wealth, and secure your future. In this video, we’ll unveil our powerful tools and strategies to help you:

- Take control of your finances: From budgeting to investing, we’ve got you covered.

- Protect what matters: Discover insurance solutions tailored to your needs.

- Find the best financial products: Our smart tools simplify your search.

- Gain financial knowledge: Empower yourself with expert-led education.

Must-Read Insights - Blogs, Articles and Stories

Don’t just read financial blogs, experience them. Our articles aren’t dry textbooks; they’re your personal finance coaches, packed with real-world advice, inspiring stories, and actionable steps to transform your financial life.

- All Posts

- Blog

- casinowazamba

- Knowledge Base Reading

- Back

- Insurance

- Finance

- Investments

{LeoVegas est considéré comme une référence internationale dans le domaine des casinos en ligne depuis son lancement en 2012. If…

Das Jokerstar Casino, betrieben von der Jokerstar GmbH, ist eine moderne Online-Spielothek, die seit 2021 durch ihre vielfältigen Slots begeistert.…

O EstacaoBet Casino, estabelecido em 2024, operado por uma empresa licenciada em Curaçao, é uma plataforma de jogos online que…